VIS Rating - An Affiliate of Moody’s has analyzed the impact of the recent transfers of four banks under special control within the framework of the new Credit Institution Law

Here's what we think:

☑️ In January 2025, the State Bank of Vietnam (SBV) announced the transfers of GPBank to VPBank and DongABank to HDBank. This follows a similar announcement in November 2024 on the transfer of CBBank to Vietcombank and Oceanbank to Military Bank, respectively. The bank transfers were executed under SBV’s bank restructuring scheme, aimed at protecting creditors and rehabilitating bank operations back to health. Prior to the transfers, the four banks were under special control by SBV after accumulating years of bad loans and significant operating losses.

☑️ The large banks that participated in SBV’s bank restructuring scheme have so far provided both management and technical resources to the transferred banks to support the overhaul of their business strategy, operational policies and processes. The large banks will receive certain benefits and dispensations by SBV, including additional quota for credit growth, lower reserve requirements, access to liquidity assistance, etc. Moreover, some of the large banks plan to inject new capital into the acquired banks after the accumulated losses are either reduced or eliminated. Stronger capital buffers will help to boost the acquired banks’ solvency and resilience to future shocks, enhance market confidence in the viability of the newly restructured banks.

“We expect the direct impact of the newly acquired banks on the large banks to be insignificant, because the acquired operations are fairly small relative to the large banks, and the large banks have sufficient resources to absorb and manage their new acquisitions,” – Phan Thi Van Anh, MSc – Director – Senior Analyst, VIS Rating.

| Key incentives | Details | Potential impact on the large banks |

| Additional credit quotas |

|

|

| Liquidity assistance |

|

|

| Lower reserve requirement |

|

|

| Regulatory dispensations |

|

|

Source: Credit Institution Law, SBV, Bank data, VIS Rating

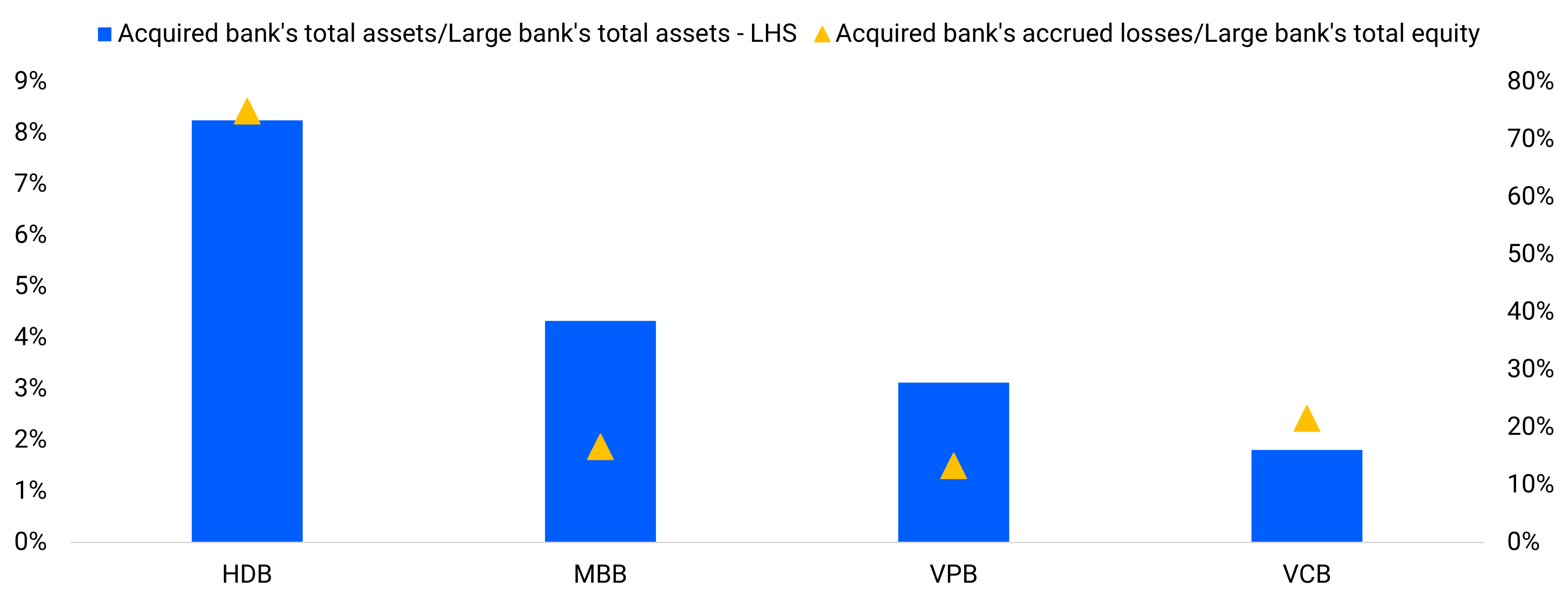

Note: Acquired banks’ financial data were in 2023.

Large banks’ financial data were in 2024

Source: Bank data, VIS Rating

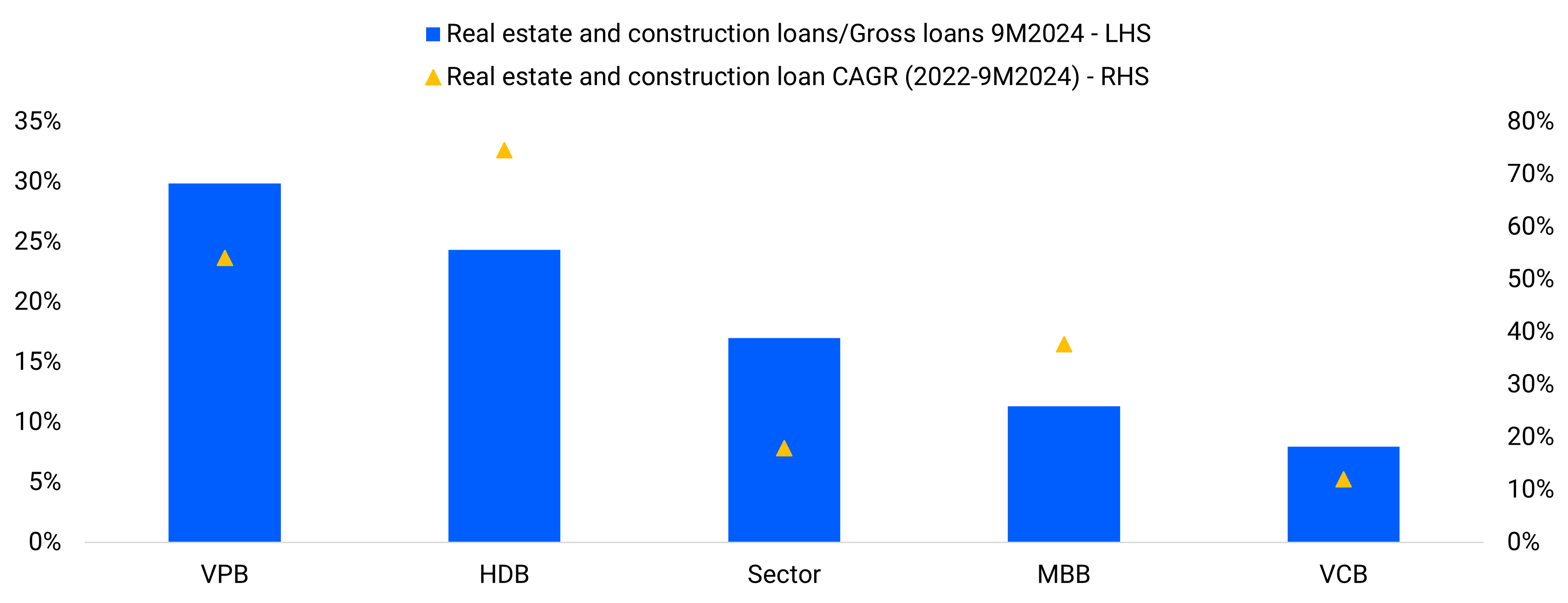

"Against the backdrop of robust economic conditions and demand for credit, asset risks may increase for the large banks that utilize their higher quotas to extend more loans to certain sectors, thereby raising credit concentration and vulnerability to event risks,” – Nguyen Duc Huy, CFA – Associate Analyst, VIS Rating.

Note: CAGR: Compound annual growth rate

Source: SBV, Bank data, VIS Rating

Be among the first to receive our reports, hear about our research updates and receive invitations to our events, sign up to be on our mailing list: https://visrating.com/

Follow VIS Rating - An Affiliate of Moody’s on our LinkedIn and Facebook pages, and engage with us as we work together to navigate the credit themes and issues critical for issuers and investors.

Contact our Head of Ratings and Research, Simon Chen (simon.chen@visrating.com, simon.chen@moodys.com) if you would like to meet with our analysts and discuss further.

#visrating #vietnam #creditinsights #creditratings #teammoodys