Banking Sector: Higher foreign ownership in banks will support banks’ pursuit of strong business growth

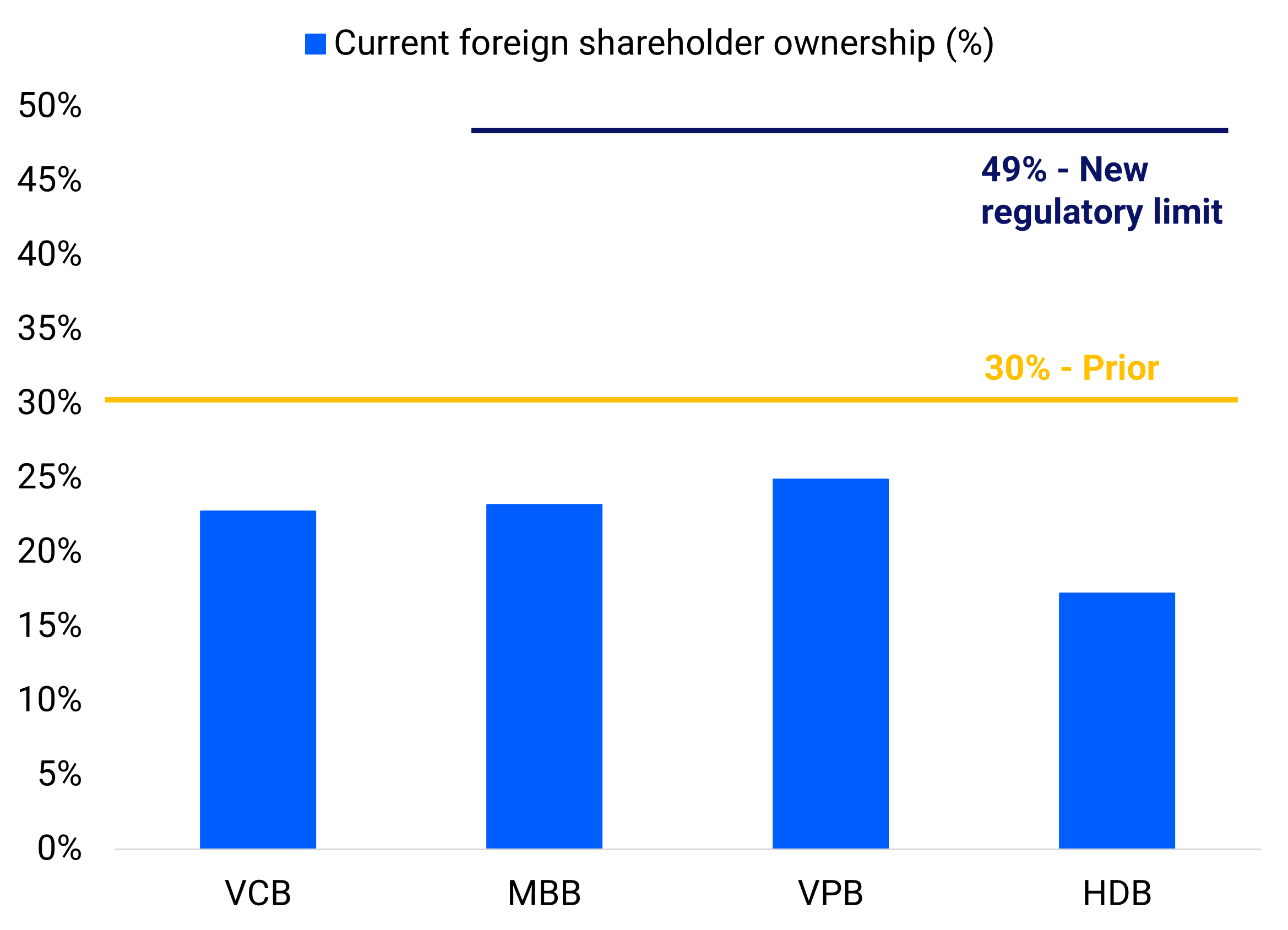

Beginning on 19 May 2025, banks participating in the State Bank of Vietnam's (SBV) bank restructuring scheme will be able to increase their foreign ownership to a maximum of 49%, from the current 30% applied to banks in general. This new SBV decree applies only to privately-owned banks. As such, out of the four participating banks, namely HDBank (HDB), Military Bank (MBB), Vietcombank (VCB) and VPBank (VPB), the higher foreign ownership limit (FOL) will not apply to VCB, a State-owned bank.

Exhibit 1: Higher FOLs will apply to HDB, MBB and VPB

Note: Refer to the Appendix for the full name of banks

Source: Bank data, VIS Rating

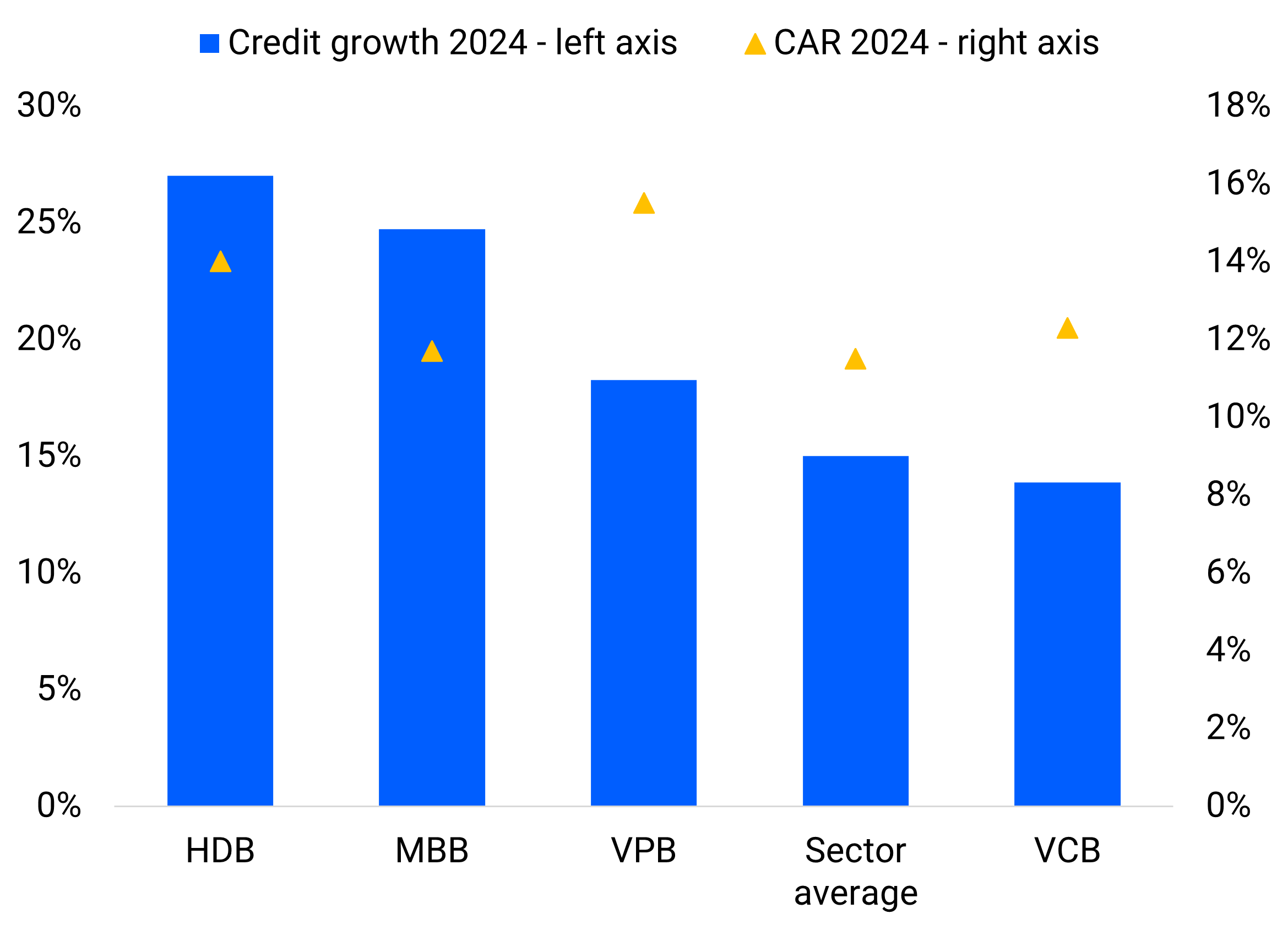

“We expect the higher FOL will provide the above-mentioned banks with an additional avenue to raise new capital to support their strong asset growth. Under the scheme, the participating banks will receive certain benefits and dispensations by the SBV, including higher credit growth quotas, lower reserve requirements, access to liquidity assistance, etc.

Assuming the participating banks maintain their above-industry-average asset growth at or above 25% and steady profitability for the next two years, we expect HDB, MBB and VPB would be most in need of additional capital to maintain current capital levels. We estimate that the banks’ capital adequacy ratios (CAR) may fall by between 150-300 basis points by the end of 2026 if they do not raise new equity or subordinated bonds” – Nguyen Duc Huy, CFA – Associate Analyst, VIS Rating.

Exhibit 2: HDB, MBB and VPB need additional capital to support above-industry-average asset growth and maintain curent capital levels

Note: Sector numbers include 28 banks, Refer to the Appendix for the full name of banks

Source: Bank data, VIS Rating

Over the longer term, foreign strategic partners can enhance domestic banks’ loss absorption buffers through capital injection and support banks' strategic business growth, risk management, and access to offshore funding.

Exhibit 3: Banks raised CAR by 2-4 percentage points from new shares issued to foreign strategic partners

| Bank | Foreign strategic shareholder | Foreign ownership (%) | Year | CAR increase |

| TPB | SBI Ven Holdings Pte, Ltd | 20.0% | 2018 | 2% |

| CTG | MUFG Bank, Ltd | 19.7% | 2013 | 3% |

| ABB | Malayan Banking Berhad | 16.4% | 2008 | Not available |

| VPB | Sumitomo Mitsui Banking Corporation | 15.0% | 2023 | 2% |

| OCB | Aozora Bank Limited | 15.0% | 2020 | 2% |

| VCB | Mizuho Corporate Bank, Ltd | 15.0% | 2011 | 4% |

| BID | KEB Hana Bank | 15.0% | 2019 | Not available |

Note: Banks' CAR increase were in the year of strategic shareholders' participation, CAR for CTG, VCB were under the Basel I framework during the participation of foreign strategic shaholders. Refer to the Appendix for the full name of banks.

Source: Bank data, VIS Rating

![]() Read the full report here

Read the full report here

------------------------

Follow us on social media channels to stay updated on sector insights and corporate bond market information:

- Facebook: https://www.facebook.com/VISRating

- LinkedIn: https://www.linkedin.com/company/visrating

- Youtube: https://www.youtube.com/@visrating

- Website: https://visrating.com/